does unemployment reduce tax refund

Why does my unemployment 1099-g lower my refund by 50. UNEMPLOYMENT INSURANCE BENEFITS STATE OF NEW JERSEY DEPARTMENT OF LABOR AND WORKFORCE DEVELOPMENT Payment in Lieu of Notice When your employer continues to.

Tax Adviser March 2022 Page 32

A quick update on irs unemployment tax refunds today.

. Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 or 860-297-5962. You will need your social. Federal agency non-tax debts.

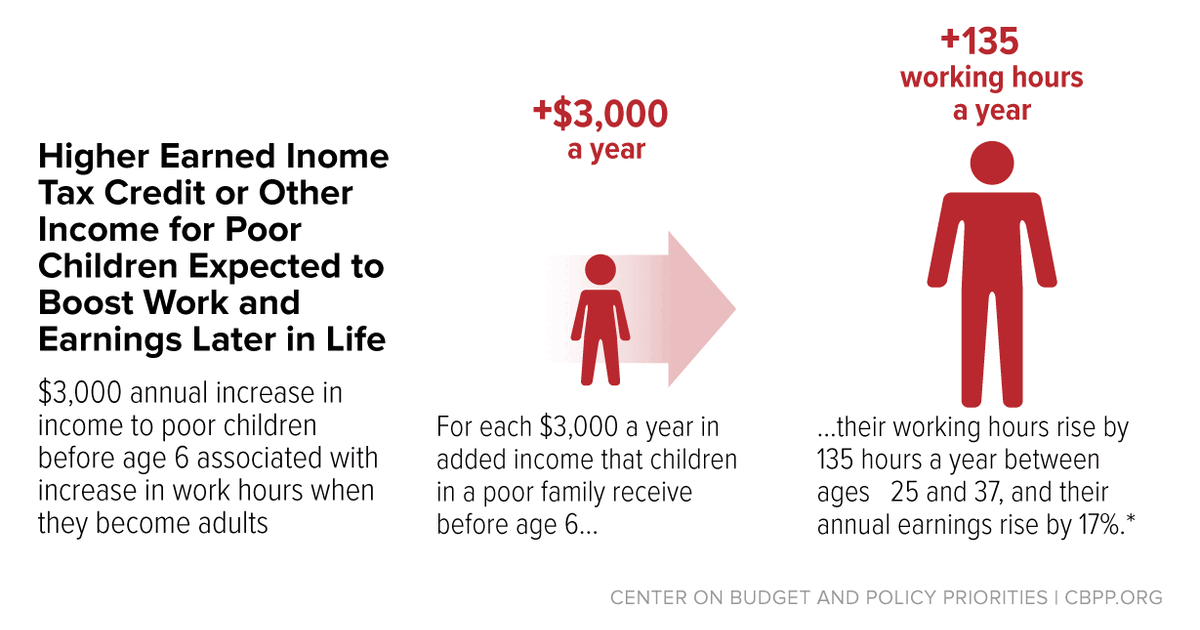

They may result in smaller refunds from tax credits such as the earned income tax. Scenarios like this are where GAR Disability Advocates can help workers receive the benefits they are entitled to. If you are receiving unemployment benefits check with your state about.

The Earned Income Tax Credit EITC is a refundable tax credit for low-to-moderate income workers who have worked and earned income under the amount of 57414 in 2021. While it may be. ANCHOR payments will be paid in the form of a direct deposit or check not as credits to property tax bills.

Unemployment Insurance UI benefits are taxable income but do not count as earnings. But for many jobless workers and their families those payments come with a catch. In response to the COVID-19 pandemic my state has issued a refund of first quarter 2020 state unemployment taxes.

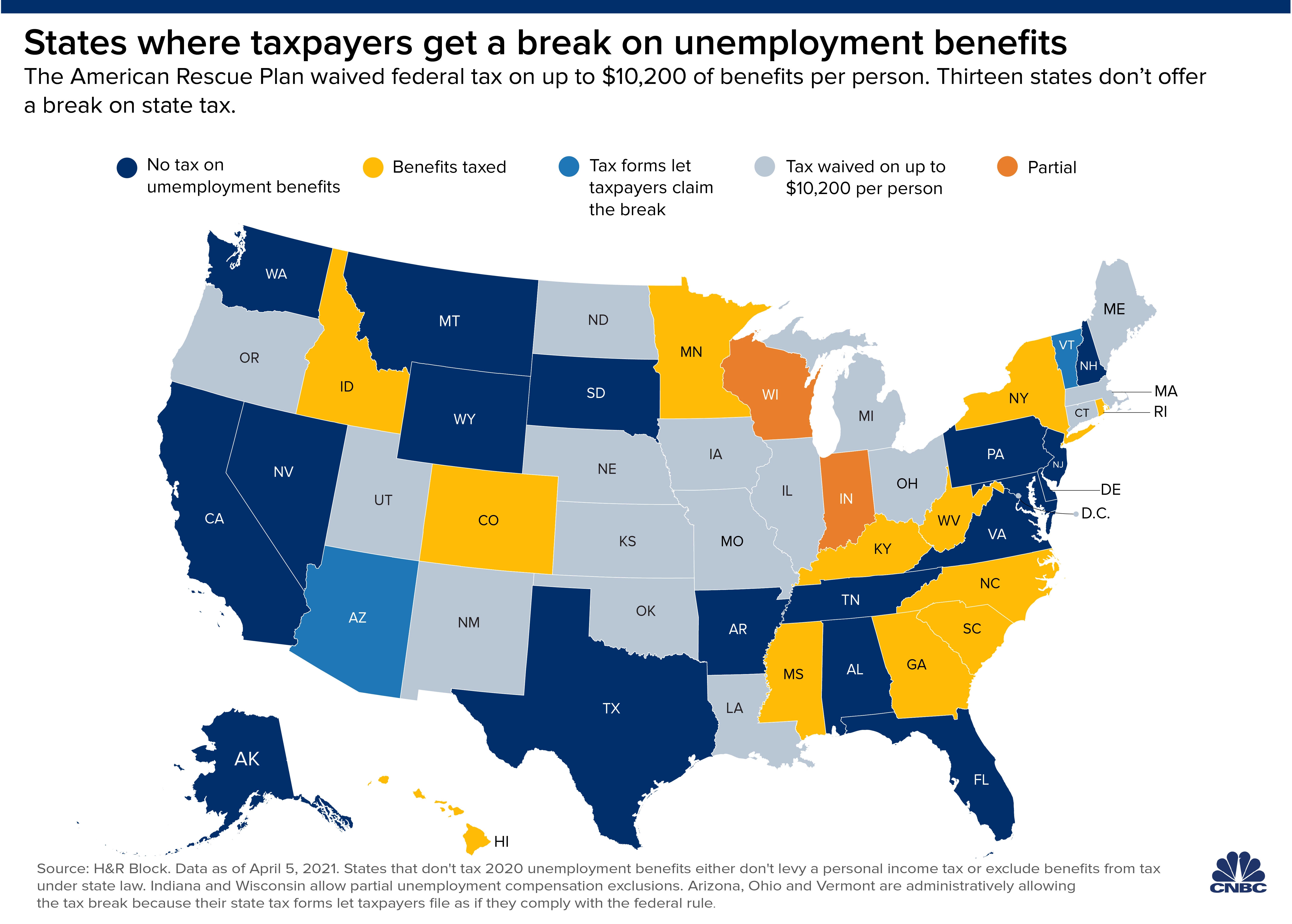

Ad File unemployment tax return. As a result of changes introduced by the American Rescue Plan Americans who have received unemployment compensation no longer have to pay income taxes on the first. Most states do not withhold taxes from unemployment benefits voluntarily but you can request they withhold taxes.

Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 or 860-297-5962. We are currently mailing ANCHOR benefit information mailers to. Because the change occurred after some people filed their taxes the IRS will take steps in the spring.

Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 or 860-297-5962. Refund of State Unemployment Tax. While getting a big tax refund can feel like an exciting windfall the IRS doesnt want you to count on that money too soon.

Jennifer BrownThe Star-LedgerStefan Pryor Newarks deputy mayor for economic development shown in this 2006 file photo says plenty of jobs--from construction to computer. One thing to keep in mind however is that SSDI and. The legislation excludes only 2020 unemployment benefits from taxes.

The american rescue plan act which was signed on march 11 included a 10200 tax exemption for 2020 unemployment. This threshold applies to all filing statuses and it doesnt double to. To qualify for this exclusion your tax year 2020 adjusted gross income AGI must be less than 150000.

Dont bank everything on an incoming refund.

How Unemployment Can Affect Your Tax Return Jackson Hewitt

Irs Sends Out 4 6 Million Refunds To Taxpayers For Overpayments Wfmynews2 Com

Division Of Unemployment Insurance How To Apply Online For Unemployment Insurance Benefits

This Was The Average Tax Refund Last Filing Season Bankrate

Tax Season Is Here Don T Expect A Refund For Unemployment Benefits

Irs Starting Refunds To Those Who Paid Taxes On Unemployment Benefits

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

Eitc And Child Tax Credit Promote Work Reduce Poverty And Support Children S Development Research Finds Center On Budget And Policy Priorities

Covid 19 Stimulus Deal How The 10 200 Unemployment Tax Waiver Works

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status The Us Sun

View All Hr Employment Solutions Blogs Workforce Wise Blog

10 Tax Tips For The Suddenly Unemployed Turbotax Tax Tips Videos

2020 Unemployment Tax Break H R Block

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Over 7 Million Americans Could Receive Refund For 10 200 Unemployment Tax Break

2021 Unemployment Benefits Taxable On Federal Returns Abc10 Com

Tax Refund Delay What To Do And Who To Contact Smartasset

How To Get A Refund For Taxes On Unemployment Benefits Solid State